Banking and Finance

Sterling Bank in trouble again! Indicted over money laundering, fraudulent deductions, others

According to them, after arrest was made and an extensive investigation carried out, the bank could not provide evidence to counter the allegations made against it by Maiden System Ltd.

Yahaya said: “We were saddled with the responsibility to investigate mismanagement, fraudulent debit, and misappropriation of funds from the account of Maiden Systems Limited by Sterling Bank.

“In the course of our investigation, findings emerged about the issue of non-issuance of statement of account, fraudulent debit, and misappropriation of funds. More importantly, Maiden Systems Limited raised the issue of accounts. There are four accounts operated by Sterling Bank Plc for Maiden Systems Limited. Two are U.S. dollar accounts, while two are Nigeria NGN accounts.

“Major remittance is coming to the account of Maiden Systems Limited, domiciled with Sterling Bank, and Shell Petroleum Development Company Limited. Now, we have cutting records from Shell over the period 2017 up to 2020. Shell failed, this is our finding, Shell failed to supply the financial reports for 2021, 2022, 2023, and 2024.

loan.

“The loan offer as of 2012 was $30 million. We need to understand it was restructured in 2017, with capital and interest to arrive at US$30 million.

“Having regard to the account, we, a team of detectives, started seeing debits, debits from Maiden System account for loan repayment. And we took it upon ourselves to ask the account officer that first came before us to explain the loan repayment but he said it was a mere narration adopted while applying funds to the company’s loan account. We found this very vague and ambiguous.

“We discovered that about US$28.3 million was debited from this company’s account for loan repayment but there’s no explanation.

“Particularly, on the 29th September, 2016, the sum of US$2,413,000 was debited from the company’s account. Account number 00148517716 for loan repayment with reference FT16271UZYO. On 14th November, 2016, the sum of US$1.256 million was equally debited from this same account for loan repayment.“While on the 16th of January, 2017, the sum of US$28,302,140.59 was debited from the company’s account for loan repayment. And like I said, we’ve waited for the bank to provide account officers who have managed this account to throw more light on this. It is not our document.“It is their own document. The facts are before them. If somebody has managed that account before and is no longer an account officer, they could call them, provide names since they are no longer in the bank.“One of the account officers specifically wrote that the outstanding balance was about US$27.25 million, while the executive director gave us a figure of over US$30 million. That is to say, nothing has been paid, nothing has been debited to clear the loan.“We equally discovered what the bank captured in the statement of account, in-branch transfer, account to account. And we asked, what does the bank or the account officers mean by in-branch transfer, account to account?“We have come up with the recommendation that, since the bank has failed to provide evidence for itself to debunk the allegation raised by Median Systems, evidence as used so far from their own statement of account corroborates the offences alleged. Financial mismanagement, fraudulent debit, misappropriation of funds and more importantly, when funds are being moved that way, if you go deeper, money laundering. We could not even go deeply towards the petitioner raising their petition.”Responding, the Chairman of the Committee, Mike Etaba, assured both parties that the report would be studied by the Committee and justice served.

“At the committee level, we will look at the Police report and I assure us that justice will prevail,” Etaba said.

Banking and Finance

Wema Bank concludes Capital RaiseSecond tranche of ₦50 Billion Special Placement fully subscribed

……Bank further exceeds regulatory requirements.

LAGOS, NIGERIA – 17th October 2025 – Wema Bank PLC (Bloomberg: Wema NL) (“Wema” or “the Bank”) announces completion of its second tranche of N50billion capital raise.

• N50billion Special placement subscribed by 100%

• Total Qualifying Capital now N264billion; above N200bn threshold

• Bank further surpasses regulatory requirements for Commercial Bank with National Authorization

Lagos, Nigeria – October 15, 2025 — Wema Bank Plc is pleased to announce that it has received all requisite regulatory approvals for its ₦50 billion Private Placement capital raise. This is in addition to the earlier ₦150bn Rights Issue that was successfully completed in September 2025. The Bank now has a total of ₦264.87billion in qualifying capital, above the minimum requirement of N200bn for a Commercial Bank with National Authorization.

This development marks another significant milestone in the execution of the Bank’s capital management program aimed at fortifying its balance sheet, supporting future growth ambitions, and ensuring full compliance with the Central Bank of Nigeria’s (CBN) revised minimum capital requirements.

Speaking on the development, Mr. Moruf Oseni, Managing Director/Chief Executive Officer of Wema Bank, stated:

“We are delighted to have received all necessary regulatory approvals for our ₦50 billion special placement. This marks another major step in our strategy to strengthen Wema Bank’s capital base, enhance liquidity, and position the institution to pursue emerging opportunities for sustained growth. We appreciate the continued confidence and support of our shareholders, regulators, and customers as we execute our growth agenda.”

The proceeds from this capital raise will be deployed to continue the acceleration of Wema Bank’s digital transformation drive, deepen penetration across retail, SME, and corporate segments, and enhance the Bank’s lending capacity to key productive sectors of the Nigerian economy. It will also support ongoing investments in technology, and human capital development — further strengthening operational efficiency and service excellence.

Wema Bank remains steadfast in its mission to deliver superior value to shareholders, empower customers through innovative financial solutions, and contribute meaningfully to Nigeria’s economic growth and financial inclusion objectives.

Banking and Finance

Fela’s Afrobeat Rebellion Aligns with Ecobank’s Commitment to Promoting African Heritage

Lagos, October 13, 2025 – Ecobank Nigeria says the ongoing “Fela Kuti: Afrobeat Rebellion” exhibition reflects its belief in the transformative power of art and culture to inspire change across Africa.

Speaking at the event, Omoboye Edu, Head of SME at Ecobank Nigeria, described the exhibition as one of the many ways the bank continues to promote African creativity and innovation.

“Hosting Afrobeat Rebellion at EPAC aligns with our mission to showcase the continent’s creative energy. We are proud to celebrate Fela’s legacy and the vibrant spirit of Afrobeat in a space that inspires dialogue, imagination, and progress,” she said.

She explained that the three-month exhibition, which celebrates the life, music, activism, and enduring influence of Fela Anikulapo-Kuti, opened on October 12 and will run until December 28, 2025.

Beyond the music and memories, the exhibition speaks to Ecobank’s broader commitment to economic growth through the creative sector. By providing platforms like EPAC, the bank continues to nurture collaboration, entrepreneurship, and cultural exchange, which are all vital to building a thriving creative economy in Africa.

At the opening ceremony, Lagos State Governor Babajide Sanwo-Olu applauded Ecobank for its unwavering support of Nigeria’s creative industry. Represented by Mrs. Bukola Agbaminoja, CEO of the Lagos State Film & Video Censors Board, the Governor noted that Ecobank’s involvement in Afrobeat Rebellion reflects its long-standing dedication to nurturing the country’s artistic and cultural heritage.

“By hosting this exhibition, Ecobank reaffirms its belief in the power of art and culture to drive economic development. The bank understands that creativity is not just an expression of identity; it’s a force that can reshape communities, build industries, and spark innovation,” he said.

Also speaking at the event, Laurent Favier, Consul General of France in Nigeria, described Afrobeat Rebellion as an inspiring blend of cultural diplomacy and artistic reclamation, praising Ecobank and its partners for championing the project.

“Supporting this exhibition in Lagos reflects our belief that culture is a bridge between nations. It builds on the success of the earlier Paris edition, celebrating Franco-Nigerian collaboration and honouring Fela’s enduring legacy,” he noted.

Supported by the French Embassy in Nigeria, Ecobank, and other partners, the exhibition highlights Fela’s dual legacy, as a revolutionary musician and fearless political visionary.

The opening night came alive with performances by Ezra Collective, Seun Kuti and several others. These performances set the tone for a season of artistic exploration inspired by Fela’s Afrobeat revolution.

Other highlights of the three months exhibition include, the Talks — a thought-leadership series featuring Yeni Kuti, Prof. Oyeronke Oyewumi, Falana, Ade Bantu, Minna Salami, and Kadaria Ahmed — and Kalakuta Cinema, a film series curated by S16 Collective, showcasing films like Music is a Weapon, Mami Wata, Timbuktu, and Finding Fela.

For younger audiences, the Young Rebels’ Corner offers an engaging creative hub for children aged 6 to 15, with workshops such as the Rebel Scrapbook, Jam Station, and Anikulapo Design Workshop — nurturing a new generation of imaginative thinkers.

The programme also features Karatu Book Readings, Manifesto: The Weapon of the Future, Òrò Abamì Spoken Word Competition, and Dance for Freedom, a movement workshop by The Mud Art Company.

Open to the public, Afrobeat Rebellion invites visitors to experience Fela’s legacy not only as a musician but as a symbol of courage, creativity, and social change — reinforcing Ecobank’s belief that when art is empowered, society is transformed.

Banking and Finance

Fidelity Bags awards for Best Export and Trade Support and Innovation

L – R: Seye Otite, Media Relations Officer; Tolulope Rojaiye, Team Member, Brand & Communications Division; Meksley Nwagboh, Divisional Head, Brand & Communications; Stanley Amuchie, Executive Director/Chief Operations and Information Officer (all of Fidelity Bank Plc); Christopher Bajowa, President, Pension Fund Operators Association of Nigeria; and Omonsegho Ibironke, Team Lead, Events and Business Promotions, Fidelity Bank Plc; at the BusinessDay Bank and Other Financial Institutions’(BAFI) Awards 2025 where Fidelity Bank bagged the awards for the Best Bank for Export & Trade Finance and Most Innovative Bank of the Year recently.

Fidelity Bank’s market leadership has been affirmed once again as the tier-one lender bagged double honours at the BusinessDay Bank and Other Financial Institutions’(BAFI) Awards 2025.

At the awards ceremony, which was held at the Lagos Continental Hotel, Victoria Island, Lagos on Saturday, 11 October 2025, Fidelity Bank was presented with the awards for the “Best Bank for Export & Trade Finance” and “Most Innovative Bank of the Year”.

Dedicating the Export and Trade Finance Award to its customers, the Managing Director/Chief Executive Officer, Fidelity Bank Plc, Dr Nneka Onyeali-Ikpe,OON, who was represented by the Executive Director/Chief Operations and Information Officer, Stanley Amuchie, said, “This recognition underscores our unwavering commitment to promoting non-oil exports and supporting Nigerian businesses to compete globally through initiatives such as the Fidelity International Trade & Creative Connect (FNITCC) and the Export Management Programme (EMP).

“I dedicate this award to all our exporters who continue to showcase the best of Nigeria to the world, our loyal customers, and our partners for their steadfast support.”

The BAFI Awards is the benchmark of distinction for institutions in the Nigerian financial services sector. Now in its 12th year, the awards recognise and celebrate organisations that are excelling in the delivery of financial services in Nigeria. The award acknowledges organisations demonstrating leadership, vision and impact in driving Nigeria’s growth trajectory.

Fidelity Bank’s recent recognition is attributed to significant accomplishments over the past twelve months. Notable milestones include the inauguration of the first privately constructed onshore oil export terminal in Nigeria in fifty years at the Otakikpo Marginal Field, which was funded by Fidelity Bank and commissioned by President Bola Ahmed Tinubu last week. Additionally, the Bank launched the Fidelity SME Hub, a multipurpose facility designed to support small businesses through innovation, collaboration, and capacity-building initiatives.

Furthermore, Fidelity Bank organized the third edition of the Fidelity Nigeria International Trade & Creative Connect (FNITCC) in Atlanta, Georgia, USA, in September 2025. This event provided local businesses with opportunities to engage in deal rooms with U.S. buyers, including prominent retailers such as Walmart and Target, fostering potential partnerships.

“The innovation award is a special one for us as it validates our continued drive to enhance operational efficiency, elevate customer experience, and strengthen business performance. We sincerely appreciate BusinessDay Media for this recognition and reaffirm our commitment to introducing more impactful innovations that empower our customers and advance the Nigerian financial services industry”, commented Amuchie.

-

Banking and Finance2 days ago

Banking and Finance2 days agoWema Bank concludes Capital RaiseSecond tranche of ₦50 Billion Special Placement fully subscribed

-

NEWS2 days ago

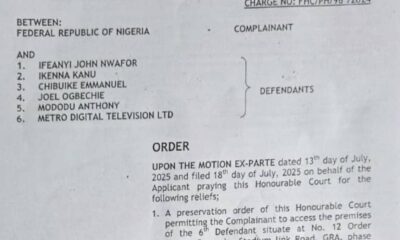

NEWS2 days agoEFCC Arrests Two Metrodigital TV Staff for Illegal Rebroadcast of DStv, GOtv Channels

-

Cover2 days ago

Cover2 days agoFrom Lagos to Athens: Why Nigerians Are Turning to Greece for Property and Residency